BTC Price Prediction: Path to $200,000 by End of 2025

#BTC

- Technical Strength: BTC trading above key moving average with Bollinger Band support indicates underlying bullish momentum

- Institutional Demand: Record illiquid supply and state-level adoption initiatives provide fundamental support for price appreciation

- Market Structure: Reduced impact from large options expiries and accumulating whale activity creates favorable supply-demand dynamics

BTC Price Prediction

Technical Analysis: BTC Shows Bullish Momentum Above Key Moving Average

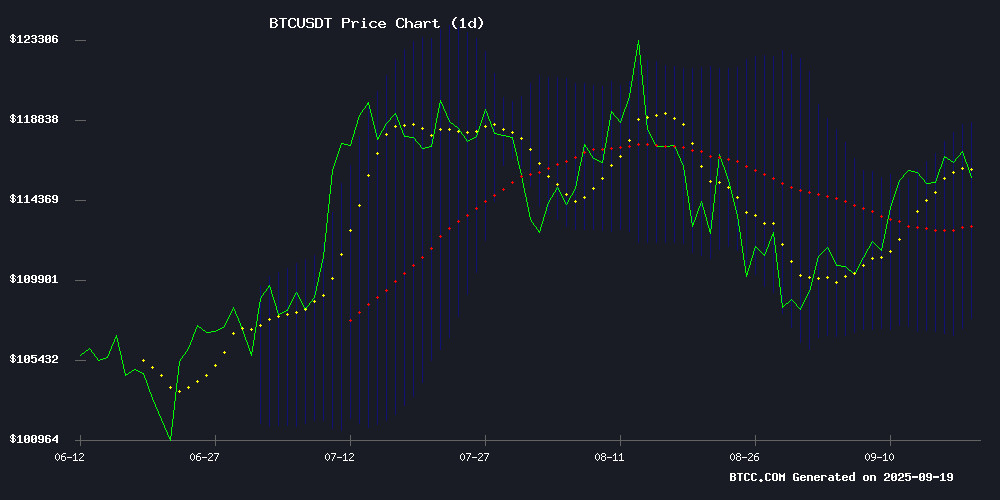

BTC is currently trading at $115,963.54, positioned above its 20-day moving average of $113,251.95, indicating underlying strength. The MACD reading of -3117.85 suggests some bearish momentum, though the histogram shows narrowing negative divergence. Price action remains within the Bollinger Band range of $107,732.74 to $118,771.16, with the middle band providing support. According to BTCC financial analyst Michael, 'The technical setup favors continued upward movement as long as BTC holds above the $113,250 level. The current positioning suggests potential for testing the upper Bollinger Band resistance.'

Market Sentiment: Institutional Accumulation and Regulatory Progress Support Bullish Outlook

Market sentiment appears constructive with several positive developments. Bitcoin's illiquid supply reaching all-time highs indicates strong whale accumulation, while Michigan's advancement of Bitcoin reserve legislation signals growing institutional adoption. The $4.9T options expiry, though significant, is unlikely to disrupt spot markets substantially. BTCC financial analyst Michael notes, 'The combination of institutional accumulation, progressive regulatory developments, and reduced selling pressure from options expiry creates a favorable environment for price appreciation. These fundamental factors align with the technical bullish signals.'

Factors Influencing BTC's Price

Bitcoin Faces Pivotal Moment as $4.9T Options Expiry Looms

Bitcoin's price stability faces a critical test with $4.9 trillion in stock and ETF options set to expire on September 20. Historical patterns suggest heightened volatility—March 2025's similar event triggered a weeks-long downturn, while June's expiry preceded BTC's slide below $100,000. The cryptocurrency currently treads a knife-edge between key technical levels where forced liquidations could amplify moves in either direction.

Altcoins show pronounced weakness, with most underperforming BTC for two consecutive months. Exceptions include newly launched tokens and Binance Smart Chain projects riding speculative waves. Analyst TedPillows notes dangerously high leverage across derivatives markets, warning of an inevitable flush-out before potential new all-time highs.

The options expiry dwarfs the entire crypto market capitalization, creating conditions reminiscent of past macroeconomic shake-ups. Traders anticipate cascading effects across digital assets as institutional positions unwind.

Fundstrat's Tom Lee Predicts Bitcoin Could Reach $200,000 by End of 2025

Bitcoin's potential to double in price by the end of 2025 has become a focal point for crypto investors. Tom Lee of Fundstrat recently stated in a CNBC interview that BTC could "easily" hit $200,000, sparking both excitement and skepticism. Currently trading at $115,000, Bitcoin would need a significant rally to achieve this target.

The cryptocurrency has underperformed relative to its previous bull runs, gaining only 20% year-to-date compared to triple-digit returns in 2023 and 2024. Despite setting a new all-time high of $124,457 this summer, BTC has struggled to break through the $120,000 resistance level, declining 3% over the past month.

Market observers note that early-year Optimism about institutional adoption and regulatory tailwinds has yet to materialize into sustained price momentum. The coming months will test whether Bitcoin can replicate its historical year-end surges or if Lee's prediction proves overly ambitious.

Bitcoin Illiquid Supply Hits All-Time High as Whales Accumulate

Bitcoin's illiquid supply has surged to a record 14.3 million BTC, representing over 72% of circulating coins, as long-term holders and institutional investors tighten their grip on the market. Glassnode data reveals a striking reduction in liquid supply, with exchange reserves dwindling amid aggressive accumulation.

Long-term holders have added 422,000 BTC to their coffers since January, while corporate treasuries and ETF issuers boosted holdings by 30% year-to-date. Fidelity projects institutional players could control six million BTC—nearly 30% of Bitcoin's ultimate supply—by 2025, creating what analysts describe as a structural supply shock.

Whale entities holding 100-1,000 BTC are now absorbing new supply at three times the annual mining rate, accelerating the scarcity dynamic that has historically preceded major price rallies. The trend underscores Bitcoin's maturation from speculative asset to institutional reserve holding.

Michigan Advances Bitcoin Reserve Plan Amid Growing State-Level Crypto Adoption

Michigan's legislative push to establish a state-run bitcoin reserve gained momentum this week as House Bill 4087 cleared preliminary hurdles. The proposal, introduced in February by Republican lawmakers Bryan Posthumus and Ron Robinson, would authorize the state treasurer to allocate funds into BTC under strict custody protocols.

The MOVE reflects a broader trend among U.S. states, with 47 jurisdictions having considered similar legislation and 26 actively progressing bills. At the federal level, the House has tasked the Treasury Department with studying the feasibility of a national Bitcoin reserve, examining critical aspects like cybersecurity and accounting standards.

3 Countries Where the US Dollar is Widely Used

The US dollar's global dominance extends beyond American borders, serving as a lifeline for economies grappling with instability. Ecuador's 2000 adoption of the greenback replaced the hyperinflated sucre, restoring investor confidence and market stability. Similarly, El Salvador's 2001 dollarization curbed inflation and attracted trade—though its 2021 Bitcoin pivot now sees the government holding 6,246 BTC worth $730.5 million as of September 2025.

These cases underscore the dollar's role as an economic anchor amid crises. Yet El Salvador's parallel embrace of Bitcoin signals shifting monetary experiments, blending traditional safe-haven assets with volatile digital counterparts.

Bhutan Shifts $107M in Bitcoin Amid Fed Rate Cut Turbulence

The Royal Government of Bhutan moved 913 BTC ($107M) into fresh wallets this week, marking its first transaction in a month. The timing coincides with the Federal Reserve's inaugural 2025 rate cut, sparking fears of potential BTC sell pressure. Bhutan's treasury now holds 9,652 BTC ($1.1B), with its investment arm Druk Holding actively accumulating digital assets.

Whales are stirring as macroeconomic winds shift. A separate dormant wallet activated after a decade, unloading $116M in BTC just before the FOMC decision. "Short-term volatility is inevitable," notes Bitget's Ryan Lee, pointing to historical patterns of price swings following major policy moves.

BitcoinZK Unveils Governance Framework for Bitcoin Layer-2 Ahead of Gate Listing

BitcoinZK is redefining the Bitcoin Layer-2 landscape by introducing a governance framework that transcends mere scalability. The project's native token, set to list on Gate in September 2025, marks a pivotal step toward its vision of a "Bitcoin Constitutional System." This initiative shifts the narrative from technical scaling to a holistic governance model integrating Bitcoin's native properties, ZK-proof verification, and institutional-grade tooling.

The project's technical foundation hinges on ZK-SNARKs, ensuring trustless validation of all user actions and cross-chain activities. Unlike Ethereum's smart contract-based Rollups, Bitcoin's scripting limitations necessitate alternative approaches—BitcoinZK positions ZK proofs as the only viable path for Layer-2 verification on Bitcoin. The design emphasizes transparency, with all verification processes open to third-party audits.

BitcoinZK's collaboration with undisclosed partners enables BTC asset integration into EVM environments, bridging Bitcoin's liquidity with DeFi and programmable asset issuance. Notably, its ZYRA token diverges from conventional utility tokens, framing itself as a "Digital Constitution"—though details on its governance mechanics remain undisclosed.

3 Tech Stocks Predicted to Outperform Cryptocurrencies

Cryptocurrencies like Bitcoin have delivered staggering returns, with BTC surging 950% over five years. Yet analysts at Grand View Research project just 13% annual growth for digital assets through 2030—far below the 29% CAGR forecast for AI chips.

Nvidia emerges as a clear frontrunner, deriving 88% of Q2 revenue from data center AI accelerators. While competitors circle, its market dominance mirrors crypto's early infrastructure leaders. The divergence highlights a pivotal market truth: exponential growth often migrates from asset classes to the platforms enabling them.

Bitcoin Price Eyes Demand Zones In Higher Timeframes – Here’s The Target

Bitcoin's recent price movement aligns with an analysis by crypto analyst TehThomas, who projected both bounce-off and resistance points. Clearing $117,000 marks a pivotal phase, with Thomas maintaining a bullish outlook.

The cryptocurrency successfully breached local highs and absorbed liquidity above the previous range. A temporary fakeout filled inefficiencies left by earlier moves, followed by a correction to $112,000. This retracement clarified the market structure, setting the stage for a push toward higher timeframe demand zones.

Key imbalances were tested during the liquidity sweep correction, triggering a bullish reversal. The $114,000 level—an inverted daily gap tested multiple times—has held firm, underscoring robust support. Market participants now watch for sustained momentum as Bitcoin approaches critical demand zones.

Michigan Advances Bitcoin Reserve Legislation with HB 4087 Passage

Michigan has become the latest U.S. state to explore cryptocurrency reserve policies, following the legislative approval of HB 4087. The bill signals growing institutional interest in Bitcoin as a treasury asset, mirroring broader adoption trends among corporations and municipalities.

The move reflects a strategic shift toward digital asset diversification, with Michigan joining a cohort of states examining blockchain-based financial infrastructure. Market observers anticipate similar proposals may emerge in other jurisdictions as regulatory clarity improves.

$4.3B Bitcoin Options Expiry Unlikely to Shake Spot Markets

Approximately 30,000 Bitcoin options contracts with a notional value of $3.5 billion expire today, marking the second major expiry event in two weeks. Market observers anticipate minimal impact on spot prices, which have trended upward despite the Federal Reserve's widely expected rate cut.

The put/call ratio of 1.2 reveals growing bearish sentiment, with Deribit data showing concentrated open interest at $140,000 and $120,000 strike prices. Bitcoin futures open interest has rebounded to $86 billion, nearing record levels, even as trading volumes decline amid heightened volatility.

Derivatives analysts note a curious divergence between rising price swings and shrinking liquidity. 'Actual volatility has increased substantially compared to last month, yet trading volume has declined instead,' noted Greeks Live in a market update.

Will BTC Price Hit 200000?

Based on current technical indicators and market fundamentals, reaching $200,000 by end of 2025 appears achievable but requires sustained bullish momentum. The current price of $115,963 represents approximately 72% growth needed to achieve this target. Key factors supporting this prediction include:

| Factor | Current Status | Impact on $200K Target |

|---|---|---|

| Technical Position | Above 20-day MA ($113,251) | Positive - establishes support base |

| Institutional Accumulation | All-time high illiquid supply | Strongly positive - reduces selling pressure |

| Regulatory Development | Michigan advancing Bitcoin reserves | Positive - enhances institutional adoption |

| Market Sentiment | Constructive despite options expiry | Neutral-positive - reduces volatility concerns |

BTCC financial analyst Michael suggests that while the $200,000 target is ambitious, the convergence of technical strength and fundamental tailwinds makes it plausible within the projected timeframe.